O cassino ao vivo é uma das experiências mais emocionantes que a Betboo oferece. Diferente dos jogos tradicionais de cassino online, onde os resultados...

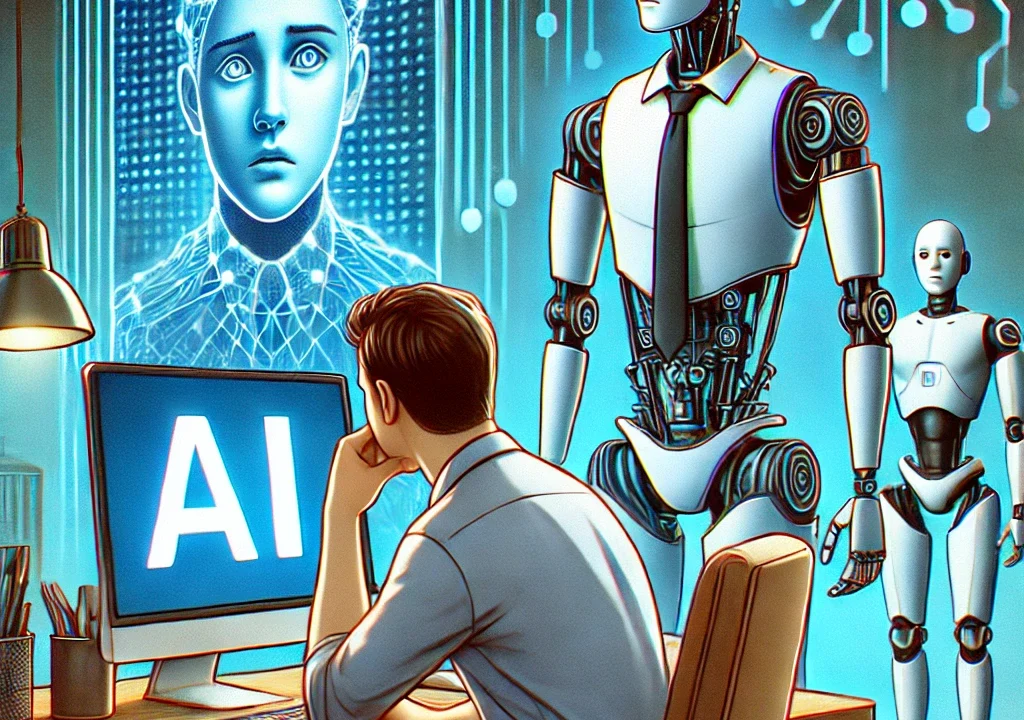

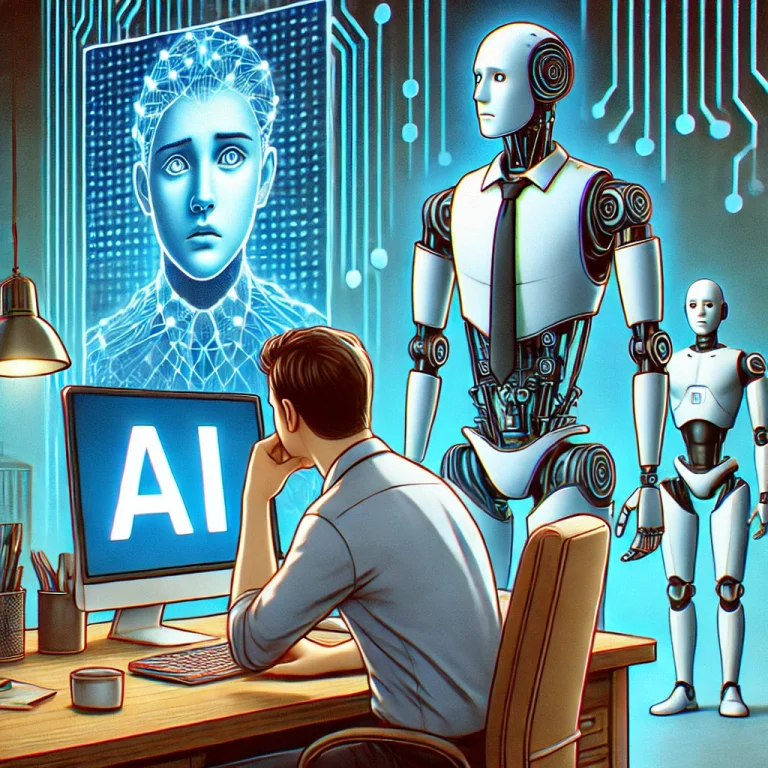

A revolução da inteligência artificial e seus impactos no trabalho A inteligência artificial (IA) tem transformado rapidamente a maneira como...

As tendências que estão moldando o futuro dos negócios A economia global está em constante transformação, e algumas áreas prometem...

Quando uma empresa gigante cai: o impacto no mercado No mundo dos negócios, até as maiores empresas podem enfrentar colapsos...

O fim do home office ou apenas uma transformação? Nos últimos anos, o trabalho remoto se tornou um dos maiores...

O crescimento das empresas sustentáveis e seu impacto nos lucros A sustentabilidade deixou de ser apenas um discurso e se...

Os investimentos que mais cresceram em 2024 e por que O mercado financeiro está em constante evolução, e 2024 trouxe...

O declínio do dinheiro em espécie e a ascensão dos pagamentos digitais Nos últimos anos, o uso de dinheiro em...

O fenômeno das startups: como elas desafiam empresas tradicionais Nos últimos anos, startups inovadoras têm conquistado mercados antes dominados por...

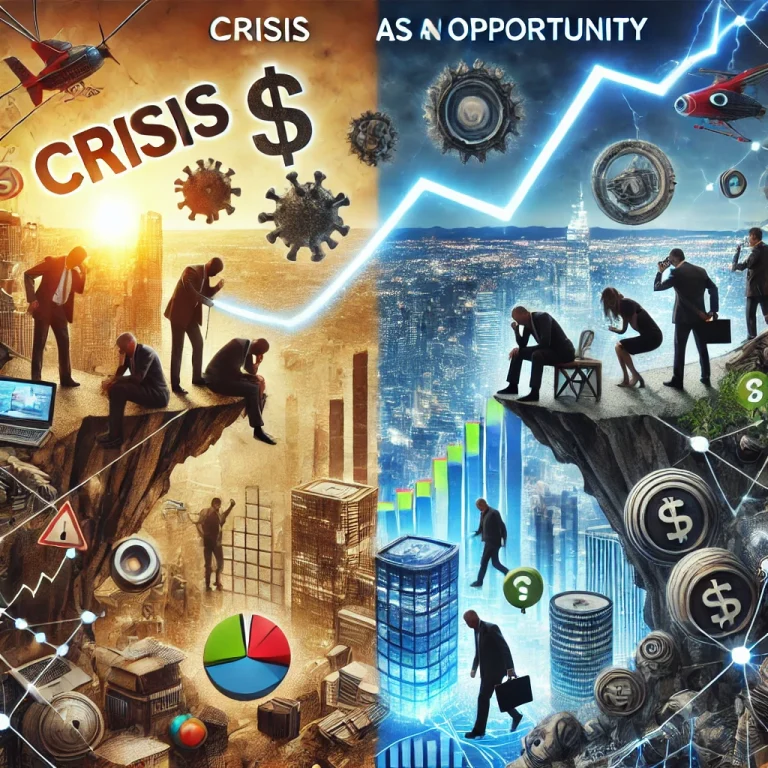

Empresas que prosperam durante crises: o segredo do crescimento Nem todas as empresas sofrem durante crises econômicas. Algumas conseguem expandir...